God has specifically chosen us to be His “money managers”.

By now, you’ve probably realized that we don’t own ANY of it! It’s all His! And because we are His servants, Christ expects an exceptional life from us, including the way we handle His money.

In Matthew 25:20-21, we are given a glimpse of what our Master expects from us;

20 “So he who had received five talents came and brought five other talents, saying, ‘Lord, you delivered to me five talents; look, I have gained five more talents besides them.’ 21 His lord said to him, ‘Well done, good and faithful servant; you were faithful over a few things, I will make you ruler over many things. Enter into the joy of your lord.’”

If you happen to have a lump of cash lying around, you better be doing something with it!

God does not accept laziness, and He wants us to look for ways to grow His resources. In the parable of Matthew 25, we are given a real picture of what it means to trust God with everything He’s given to us. If we multiply His resources, He blesses us. If we hide it away and sit in fear, He curses us.

So let’s look at some ways that we can begin to venture out into the world of investing…

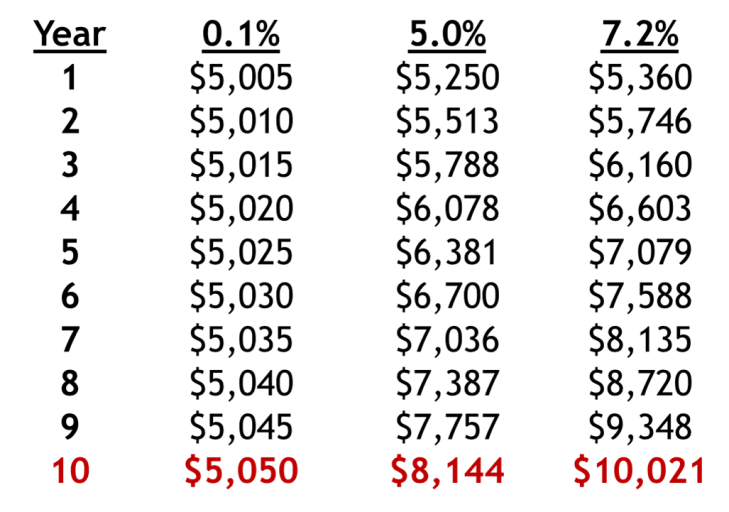

Here is a helpful graph that shows what were to happen if we invested $5,000 over different periods of time.

Let’s look at a period of 10 years. Column one illustrates what would happen if you left your $5000 in a local bank, one-tenth of one percent is the current going rate. So at the end of ten years…a whopping $50 dollars gained!

Now let’s say that you were able to invest the $5000 and earn 5%, in ten years you would have $8,144 – a bit better than the bank!

Finally let’s see what would happen if you invested your $5000 in a professionally managed account (which we do at SPM) that earned 7.2%. At the end of 10 years your money has almost doubled! Which one of these would earn the remark “Well done good and faithful servant”?

When you starting thinking about investing, make sure you have as a starting point, a cash reserve that equals approximately 3-4 months of your monthly bills. Beyond that, seek a professional to help you identify suitable investments that will help you achieve your short and long term goals.

If you have already become an investor don’t become complacent. Review your rates of return, check on the progress you are making as you save for college funding or retirement. Analyze your real property – did you know there are very creative ways to charitably gift an appreciated asset in a tax-favored way?

And finally, always review the status of your giving. Make sure that as you become more “profitable” you continue to increase your giving accordingly. Self-centeredness has a unique way of creeping up on us and causing us to spend on meaningless, empty, material possessions. So invest and invest wisely but constantly remind yourself that these are not your assets but they belong to the LORD. Your attitude with respect to your financial resources will indeed reflect the level of your faith!

This topic has been on my mind a lot lately! I’m sure there’s room for a sit-down discussion here! I believe too often I’m guilty of fear in this area – something I definitely need to work on.

You know, I think fear is something a lot of women deal with. I’ve definitely dealt with it myself. The good news is, the more you know about your investment, and especially who your advisor is, the more safe you feel putting that money into a different place. Where I think most of us drop the ball is the fact that we “think” we are doing the right thing by keeping our extra money in the bank, but we’re really missing the whole point. Thanks for your comment Lindsey! Would love to sit down and talk more 🙂

That is a great graph for a VISUAL! This post reminds me of a great book: “The Richest Man in Babylon”.

oo I’ll have to check that out! There are some great books on this topic, one that was brought to my attention today was one of Alcorn’s books, he has a lot of great ones too. People should be reading about this topic more! 🙂