Hey All! Happy New Year to you, I hope you enjoyed a special holiday season with your loved ones.

As many of us are aware, this Christmas season can be a little hectic, and VERY expensive. Most Americans go way outside of their budget during the holiday season and by New Years, find themselves in financial trouble – whether it be on a small scale or a much larger scale.

Enter the “no-spend challenge”.

We can all use a reset once in awhile – and that is exactly what this challenge is meant to do – reset our priorities, motives, and get us right back to saving for the rest of the year.

Before you begin the rules of a no-spend challenge, it is wise to review your yearly financial goals. What would you like to do differently this year?

Is it your goal to simply save more than you did last year? Or are you hoping to make a big purchase that requires a little extra planning? What about your retirement goals? Have you made progress towards them, or have you put that on the back burner for way too long? I think we are all guilty of that one!

As you review your goals start to list the things you might want to change this year in comparison to last year. If you have a budget to look over from last year, now would be the perfect time to do it! Look at the categories in your budget that need work, and decide how you can change certain spending habits throughout the coming year.

Last but not least, commit to a spending freeze. Trust me, it won’t last forever – just 30 days, but doing this can change the way you look at your finances. Who knows? You might even decide to do a few spending freezes throughout the year! It really is eye-opening and can cause you to reflect on what drives you to spend frivilously.

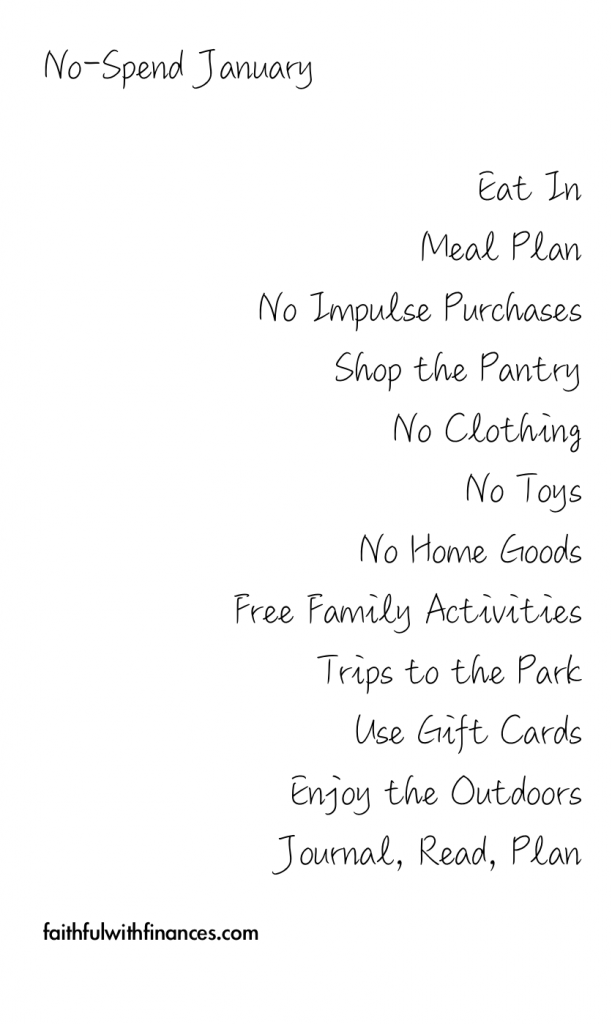

I’ve challenged myself to commit to the following rules, and I would love for you to try it! If this is up your alley, leave a comment below and let me know if you will join me in this “no-spend January”. Excited to have you along for the ride!