At some point in our lives, we typically will take on debt. Whether it is to gain a higher education, have a good mode of transportation, or even to get our family into a nice home. Debt is readily accessible in our culture, and we are enticed into the fact that we can have what we want RIGHT NOW. The other day I was sent a quote, and it really struck home, “Pay Today, Play Tomorrow!” said Prudence. “Play Today, Pay Tomorrow!” said Mediocrity.

At some point in our lives, we typically will take on debt. Whether it is to gain a higher education, have a good mode of transportation, or even to get our family into a nice home. Debt is readily accessible in our culture, and we are enticed into the fact that we can have what we want RIGHT NOW. The other day I was sent a quote, and it really struck home, “Pay Today, Play Tomorrow!” said Prudence. “Play Today, Pay Tomorrow!” said Mediocrity.

Prudence can be defined as skill and good judgment in the use of resources. It just so happens that we have to use our financial resources every day, and as I have mentioned in many previous posts, the Lord doesn’t accept our second best in this category.

Just to give you an important verse on this topic, let’s look at Proverbs 14:15 which tells us, “The simple believes everything, but the prudent gives thought to his steps.”

This verse gives us a great amount of wisdom, (what do you expect, it’s Proverbs!), and it can be related to our finances. Being prudent in your finances does not mean being afraid of taking risks, it doesn’t mean keeping all of your money in one place, and it doesn’t mean constant reluctance in spending. Prudence is the careful act of watching your steps, and knowing that God is guiding them.

So let’s get into the subject of relieving your debt faster. There are different forms of debt, some of which I mentioned above, that are permissible to have, yet others you should immediately try to get rid of. I like to put debt into two categories: OK debt and REALLY BAD debt. Let me give you some examples below…

OK DEBT

- Buying a House (with a good down payment)

- Student Loans

- Business Loans

- Loans on an Asset that can Appreciate

REALLY BAD DEBT

- Credit Card Debt

- Brand New Car (that you can’t afford)

- Co-signing on someone else’s debt

- Financing an appliance, piece of furniture, or surround-sound system

- Buying a Depreciating Asset

Now, I just want to say right away, if you do have any of the “really bad debt” in your life right now, you are not a bad person!

Everyone has the temptation of taking on these forms of debt, and sometimes, people can afford to have these things within their lifestyles. The fact of the matter is that many people can’t afford these things, and continue to live their lives as though they can. So where do you go from here?

Begin to take the steps to eliminate those really bad debts, and also continue to work towards financial freedom, which of course means NO DEBT, and the ability to truly live your life worry-free after retirement.

Two of the most common ways to tackle debt are the “snow-ball” technique, and the “avalanche” technique.

The “snow-ball” is pretty much self-descriptive, you start paying off your smallest loans first, and then start to tackle the bigger ones, and before you know it, you’ve created a “snow-ball” effect that is driving down your interest.

The “avalanche” is another way of reducing debt, and also the most effective (because you pay the least amount of interest). With the avalanche, you start by paying off your loans with the highest interest rate, and then you continue on down to the lowest interest rate. Along the way, you are saving hundreds of dollars in interest just by tackling that highest rate first.

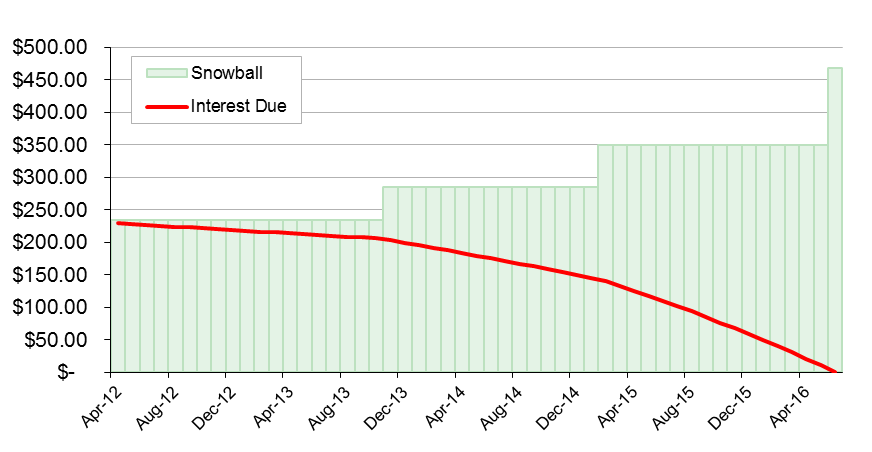

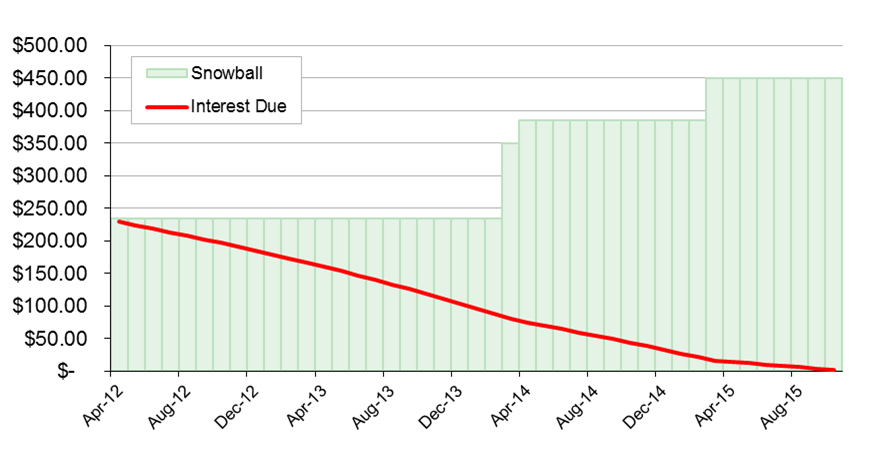

Let’s look at a couple graphs to show both the “snow-ball” and “avalanche” for a person who is in debt around $17,000. They have $5,000 in Student Loans with a 5% interest rate, they have $7,000 in Credit Card Debt with a 25% interest rate, and they have $5,000 owed on a brand-new car with a 15% interest rate.

This person knows that with their current financial situation, they can make a total monthly debt payment of $500. All of their minimum payments are equal to $265.00. Yet they are choosing not just to do the minimum, because remember, minimum will never get you where you want to go!

Here is the comparison of what they would pay in interest in the two different options:

SNOWBALL

Total Interest Paid: $8,031.24

AVALANCHE

Total Interest Paid: $4,455.50

The important point to remember through all of this is that in both of these situations, this person made the same monthly payment of $500, but simply chose to put it towards different causes.

I hope this gave you a more clear understanding of how you can relieve your debt faster, and don’t forget, today is the perfect day to start!

By: Erika Pizzo

Pingback: Can Money Affect Your Marriage? | Faithful with Finances for Women