It’s easy for us to look at someone who is financially savvy and say to ourselves “well they are just good at budgeting” or “they have a higher income so it’s easier for them” or even “they just have more

Cultivating Your Financial Garden

It’s easy for us to look at someone who is financially savvy and say to ourselves “well they are just good at budgeting” or “they have a higher income so it’s easier for them” or even “they just have more

We often find ourselves rushing and hurrying from one thing to the next. Before we know it our day has completely evaporated before us and we haven’t caught a moment to breathe! In the midst of it all, we find

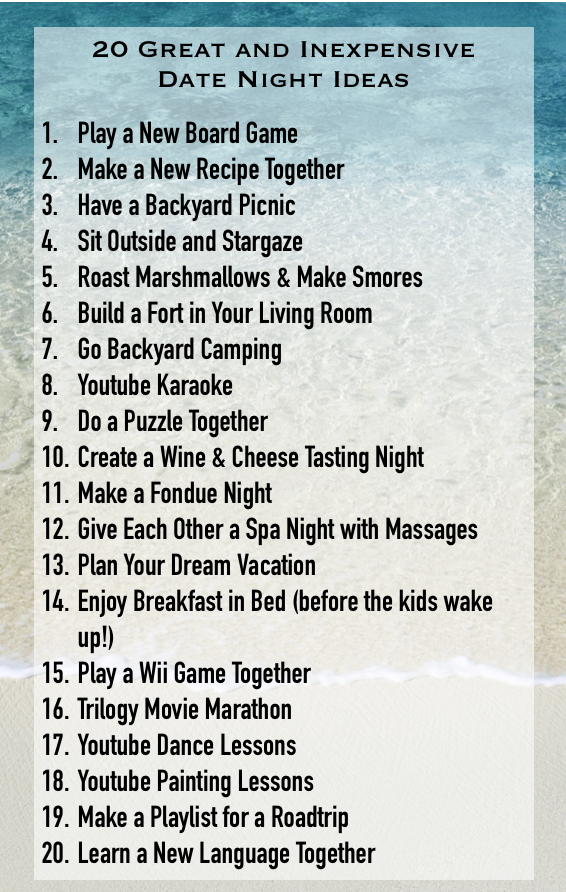

Surprise suprise, romance is not just found at some exotic place or fancy restaurant, it can be found right within your home! One of the keys to balancing your budget and your finances is to find ways to be creative

As the world stands still this Easter, we are called to reflect, look back, look forward, and at the same time, stay right where we are in the here and now. What has the here-and-now taught you? Are you prone

I bet you’ve been watching the stock market lately. One day you will see a particularly low low, and another day things start looking up. It really is a constant rollercoaster and symbolizes a lot of the emotions and attitudes

Hey All! Happy New Year to you, I hope you enjoyed a special holiday season with your loved ones. As many of us are aware, this Christmas season can be a little hectic, and VERY expensive. Most Americans go way

Working parents everywhere can resonate with the age-old question “Do you have to go to work today?” Our kids will groan and complain and even flat out tell us not to go! Our heart breaks a little inside. We hate

The concepts of generosity and saving are often neglected in our culture and not taught to our little ones. Once they reach their adult years, many will struggle to develop a real budget, save for anything long term, or experience

Kids are accustomed to learning all kinds of things from us. Our habits, the way we order our food, our favorite movies. Whether we like it or not, they are watching! We can either chose to be intentional with

We all know saving is a very important practice, yet many of us find that at the end of the month, this task is much harder than it seems at first. Yet because of the vast array of plans

Trader Joe’s is one of my all-time favorite places to shop. They seem to have every little ingredient you need for a recipe as well as some fun goodies to throw in the cart – all at VERY reasonable prices.

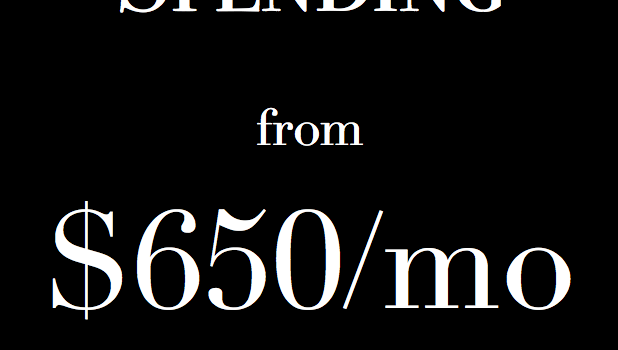

I consider our grocery budget a work in progress. There isn’t a day that goes by where I don’t think about how I can cut back, or where I can save. It’s the most variable part of our budget, and

Christmas is my favorite time of year. I’m one of those weird people that actually looks forward to it all year long. Christmas is a chance to enjoy the company of loved ones, share special gifts, and remember the birth

For those of us that have full-time jobs, part-time jobs, or are just chasing kiddos around all day, it really isn’t the most practical thing to take up couponing. We’re not actually lazy, in fact, we have LOTS to do

If you’ve been intimidated to start a budget for the simple fact that you aren’t sure how to make one, have no fear, this free budget printable will make it extremely easy to get started! Just download, print and fill

If you haven’t jumped on the coupon bandwagon yet, have no fear, there are painless and easy ways to get started… and they are right on your phone! While there are great savings with clipped coupons, digital coupons can yield

When the budget gets tight, one of the first things to go is “date nights”. The cost of going out to a restaurant, seeing a movie, and paying a babysitter can add up! We’re here to tell you that date

With Spring cleaning in full-force, many of us are getting our homes ready by decluttering, organizing, and cleaning! Take a trip down the cleaning aisle at your local grocery store and you will find unbelievably high prices. A simple bottle

For many of us, the idea of “meal planning” sounds daunting. Who has the time to put together perfectly planned meals, buy all the ingredients, and get it done in one day? Or even a series of days? The key

If you’ve ever wondered about the possibility of living on one income, you are not alone. Many families choose this option and thrive under these circumstances. Sure, it takes a great amount of dedication, but you too can accomplish this in your